This includes how agencies and clients approach their billing and payout preferences. Agencies in Australia, Canada, and New Zealand have certain tax-based issues to consider. This article will detail how to manage billing and payout settings in the Billing Info page.

| This article applies only to Agency Partners. For Direct accounts, please return to the help center home page and search for another article. |

| Important: Any references to taxes are for informational purposes only and should not be considered tax advice. Please contact your tax advisor for additional assistance. |

| Tip: Are you looking for information about Constant Contact’s Email and Digital Marketing product? This article is for Constant Contact’s Lead Gen & CRM product. Head on over to the Email and Digital Marketing articles by clicking here. Not sure what the difference is? Read this article. |

Users:

| Administrators | ✓ | |

| Company Managers | ||

| Marketing Managers | ||

| Sales Managers | ||

| Salespersons | ||

| Jr. Salespersons |

This documentation is meant to show how to configure payout account, payment method, and other billing settings on your Agency Partner account.

This documentation does not contain information on the many aspects and inner workings of Lead Gen & CRM's billing system. Refer to other articles on other parts of the billing system, or contact Lead Gen & CRM Billing Support at crm-billing@constantcontact.com for more information.

If you are in an area where the Lead Gen & CRM platform supports it, you are able to bill your clients through our payment processor. All charges to your clients are 100% on behalf of your agency, and will be paid out to you directly. Your clients are billed in the same currency that Constant Contact bills you in.

In order to start billing your clients in Lead Gen & CRM, you will need to designate a bank account into which the payments from clients will be deposited.

Be aware that this connection is only for the payments from your Lead Gen & CRM clients, and this information will not be used to charge your agency. The payment method information for your agency to pay Constant Contact is entered as a separate step, even if you wish to use the same account.

To designate bank accounts and set up billing of your clients, you will need to integrate your Lead Gen & CRM account with our 3rd-party payment processor (Stripe). You will be establishing an account directly with Stripe for them to process those charges on your behalf.

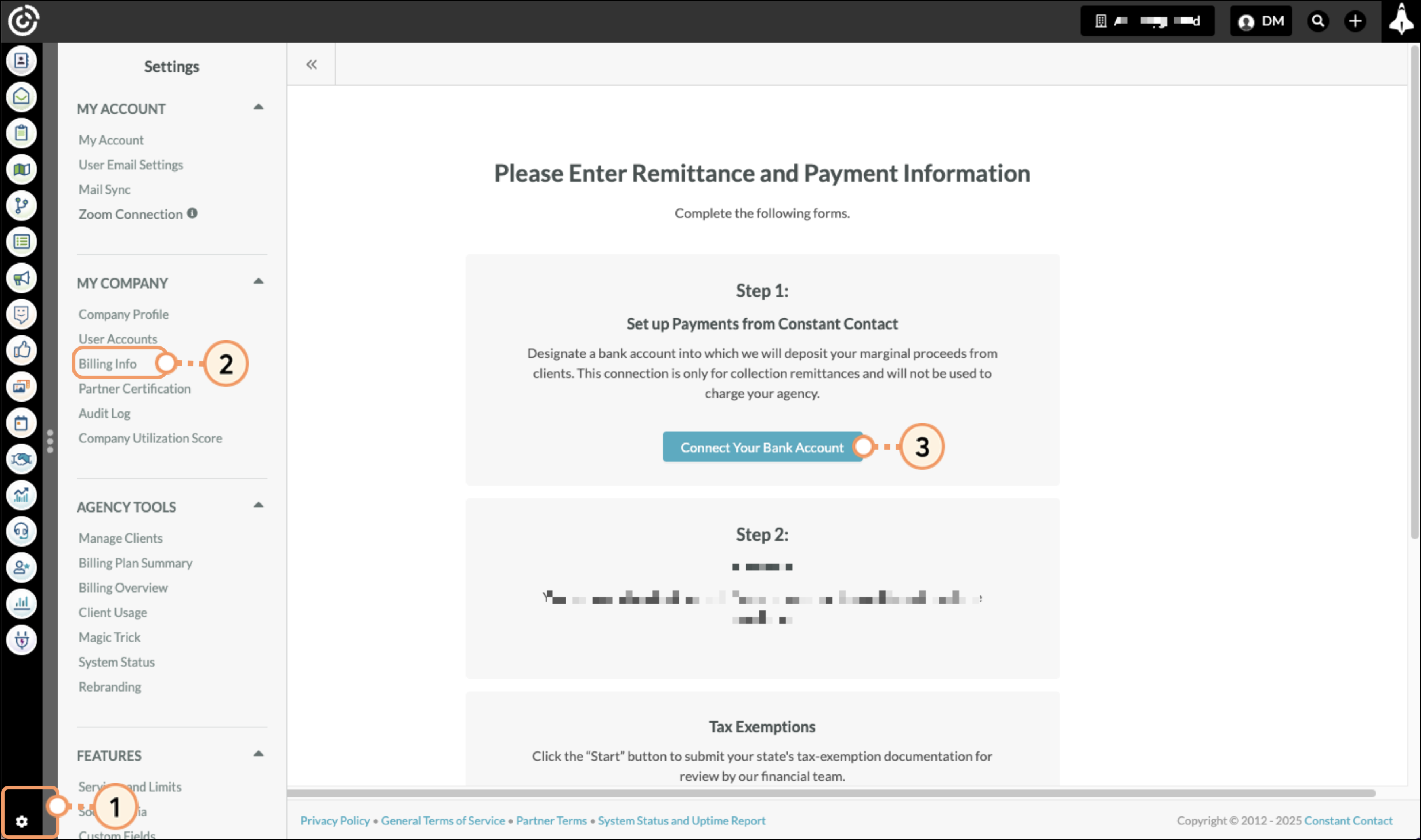

To enter bank account information, do the following:

Refer to Stripe's external documentation for additional information on entering information into Stripe.

Note: If you go Back in your web browser, you will need to start the integration process from the beginning.

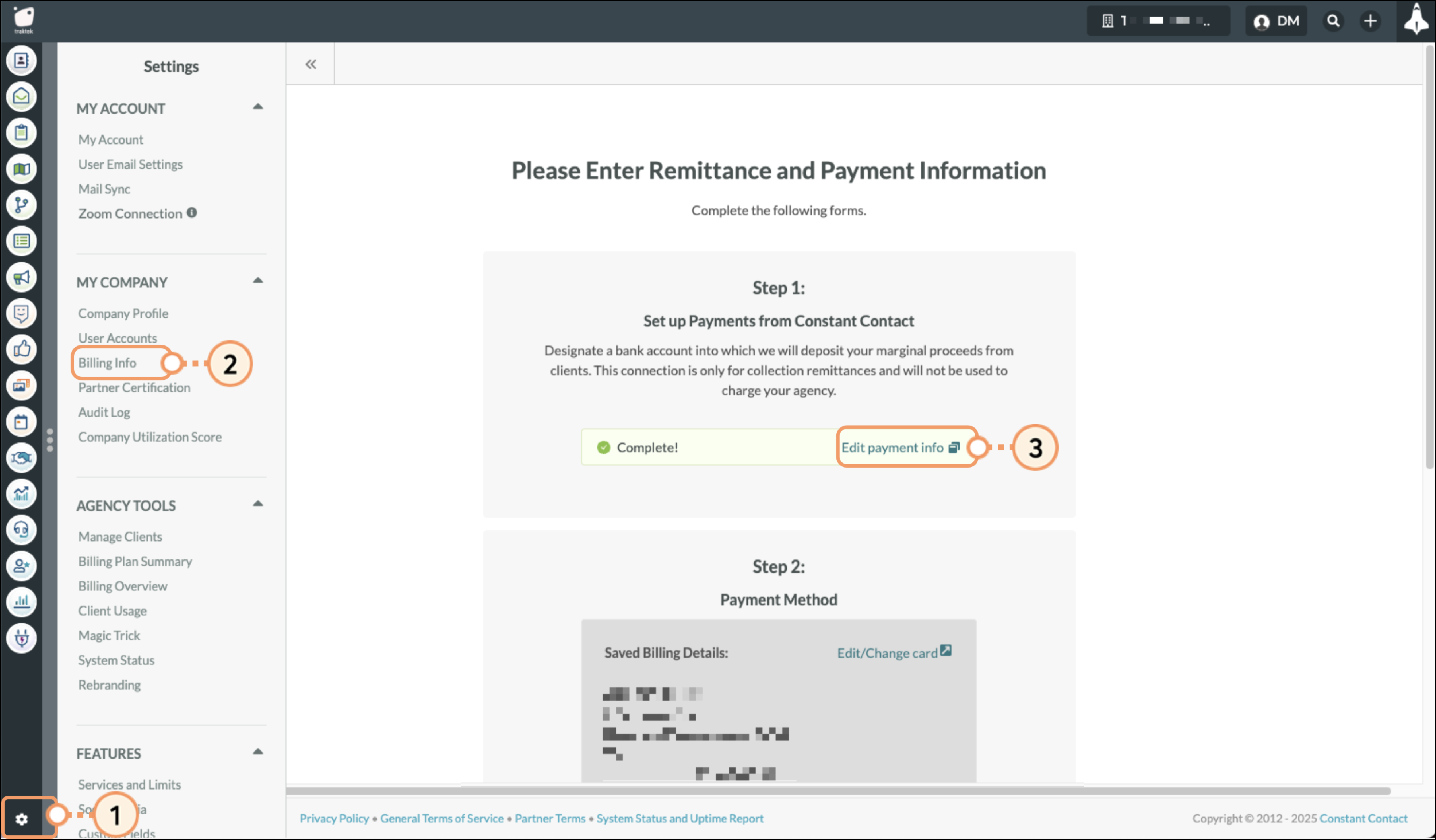

There may be a time when you need to edit your designated payout account. To edit previously saved bank account and payout information, do the following:

You can exit the Stripe browser tab once you have configured your information. Refer to Stripe's external documentation for additional information on editing information in Stripe.

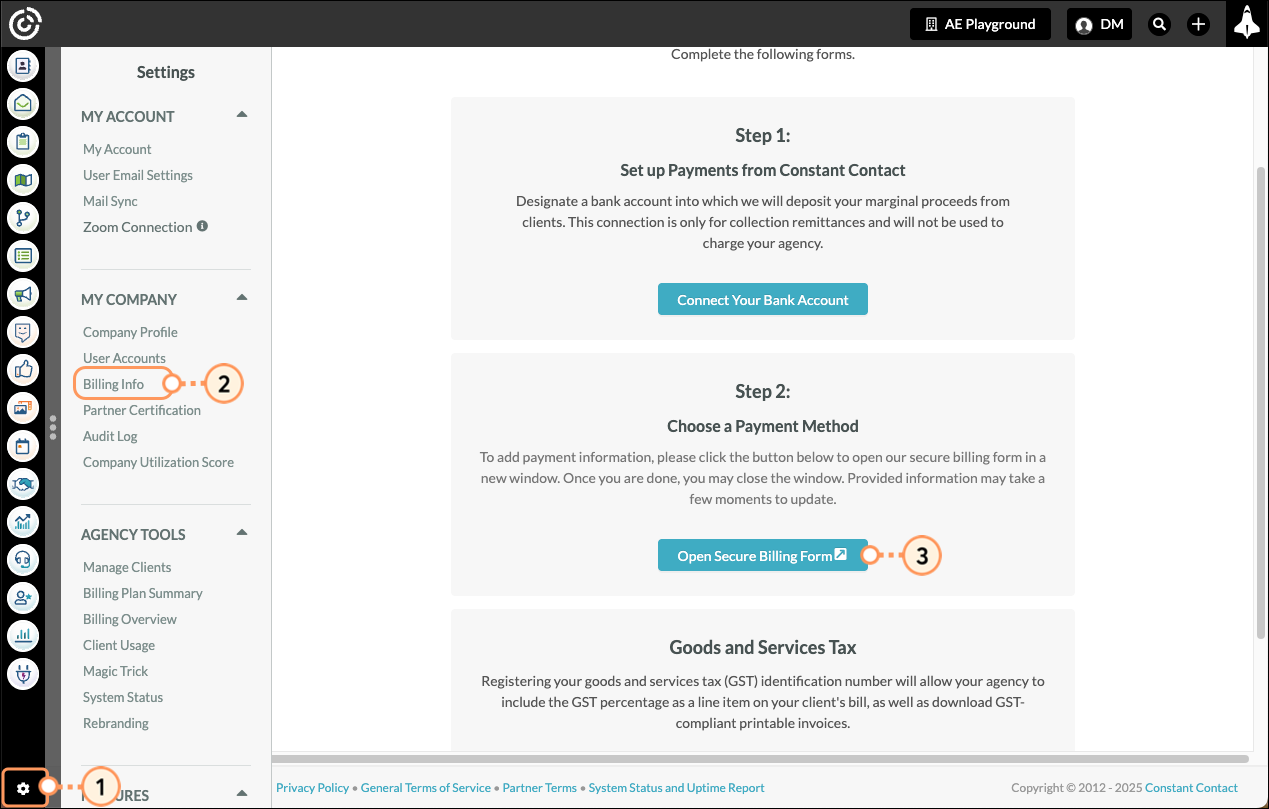

You will need to enter valid payment method information in order to pay license and service fees to Constant Contact for Lead Gen & CRM.

Depending on your location, you may be able to enter payment information that utilizes either a bank account or a credit or debit card as a primary payment method. Lead Gen & CRM strongly recommends using the bank account payment method if available, as it typically does not require as many updates to the associated account or billing information.

You will have 30 days to enter your payment information once you have created an agency account in Lead Gen & CRM. If you do not enter payment information before your first payment is due, your account will be suspended until that information is provided.

Click Save to save your changes. You will receive either a confirmation or error message regarding the validation of the payment method.

Note:

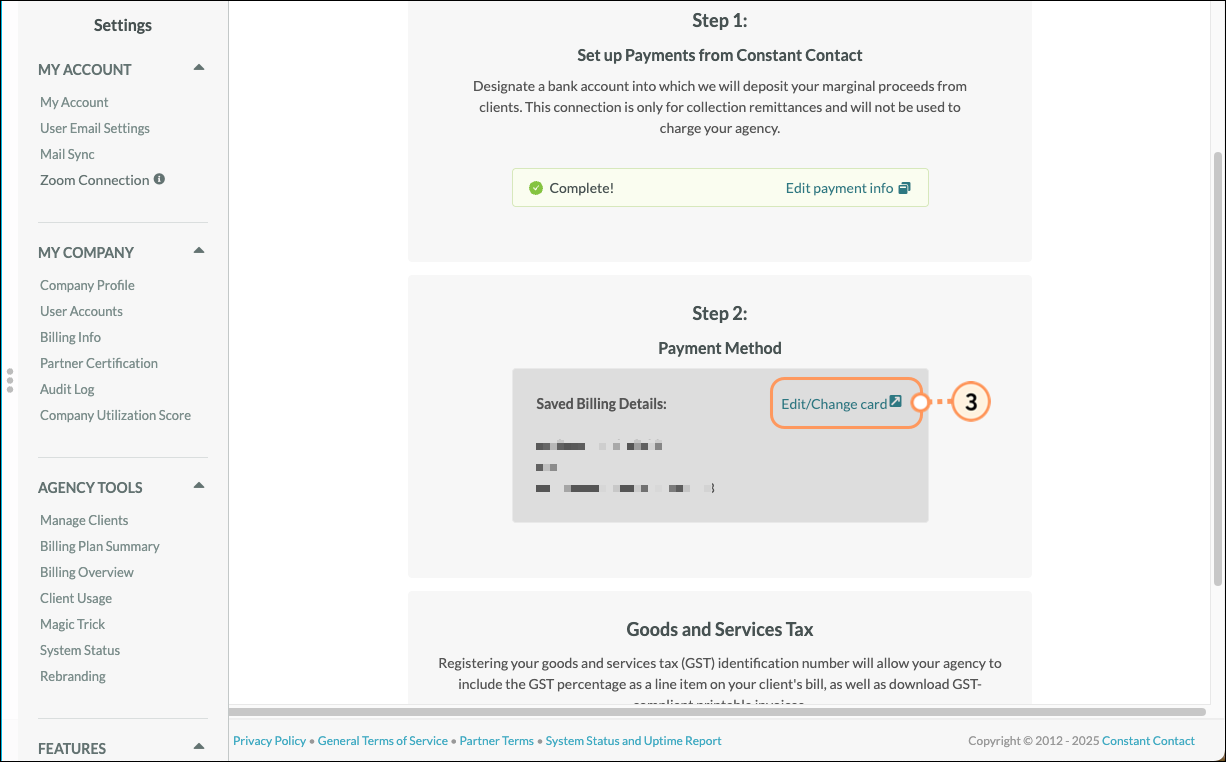

There may be a time when you need to update or edit your credit card payout information. To edit your saved payment information, do the following:

If you wish to be able to use this payment method across other Stripe-enabled websites, you can enroll the associated email in Stripe’s Link service, but it is not required in order to save the payment method for charges through Constant Contact. If you want to use Stripe’s Link service, enter your desired phone number to proceed with that enrollment. Otherwise, uncheck the “Save my information” box.

If you have already enrolled in Link, you will first see a screen asking you to confirm the code that Stripe has sent you to log into your Link account. If you do not wish to use a payment method saved to your Link account (or cannot complete the identity verification), click the “Pay Without Link” option.

Click Save to save your changes. You will receive either a confirmation or error message regarding the validation of the payment method.

Notes:

When saving new payment method information, your newly saved payment method will replace your previous payment method.

This verification process is normally instant, though it can take a few minutes to complete.

If your agency is located in Australia, Canada, or New Zealand, you will need to enter goods and services tax (GST) information in order to receive payments.

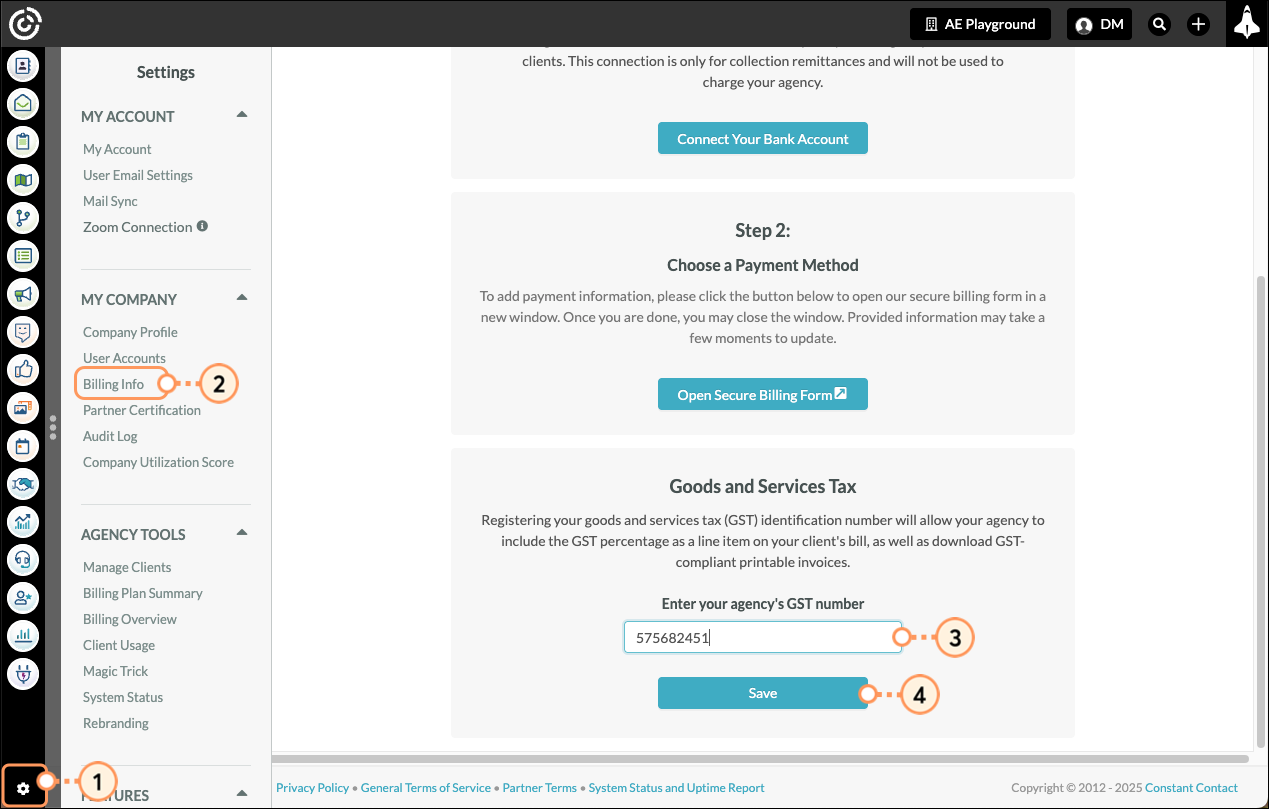

To enter GST information, do the following:

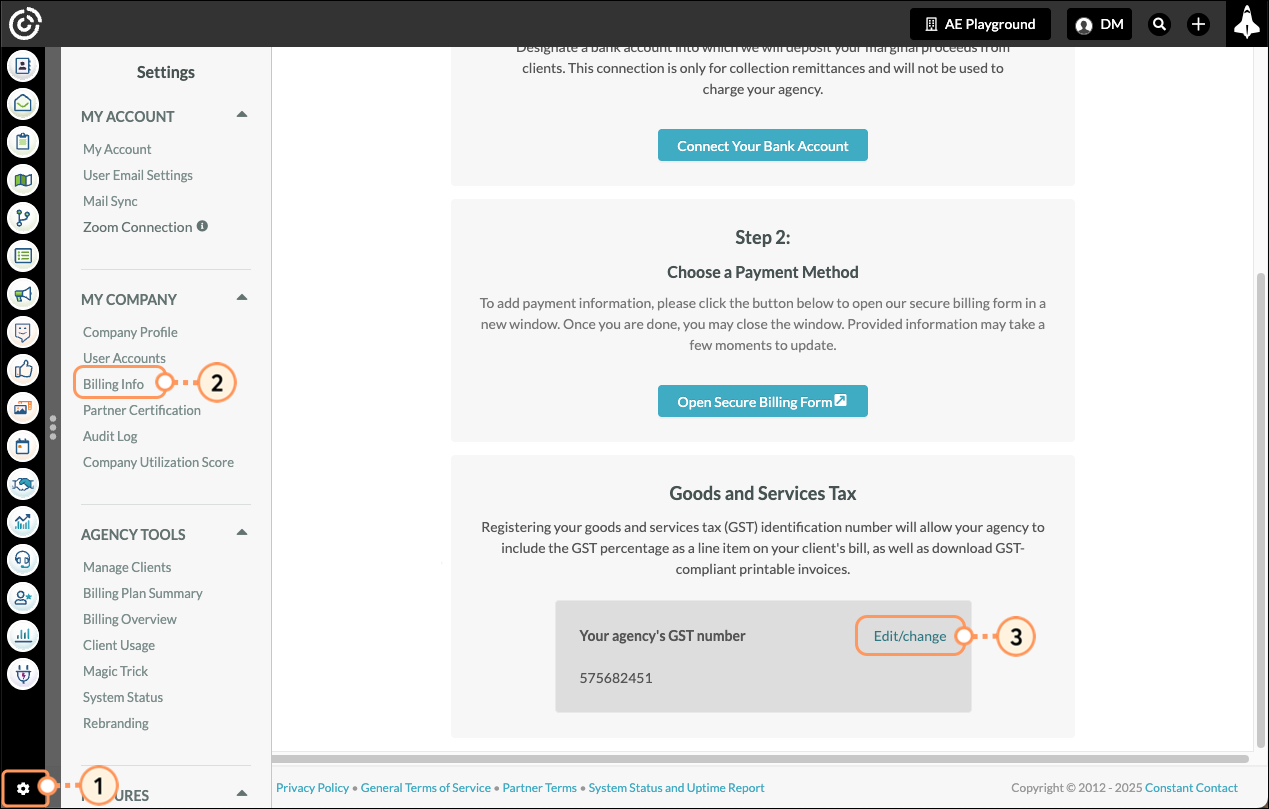

You can edit your GST information as necessary. To edit GST information, do the following:

Constant Contact provides the option on the client configuration page for you to charge your clients Goods and Services tax (GST) if needed, but it is not a system requirement. If you do decide to charge your clients GST through the billing system, keep in mind that you will still retain 100% of the amount collected from the client (GST included). So it will be your responsibility to pay the collected tax directly to the tax authority. We are unable to provide any tax advice or guidance regarding your clients. Please contact your tax advisor for additional assistance.

See Managing Client Configuration Settings for Clients in Australia, Canada, or New Zealand for further information on collecting GST from your clients.

Copyright © 2026 · All Rights Reserved · Constant Contact · Privacy Center