Your monthly bill is based on your selected plan and your contact tier. Read through the information below to get a better idea of how and when you're billed for Constant Contact.

| Important: Looking for pricing information? Check out the Plans & Pricing page in your account. |

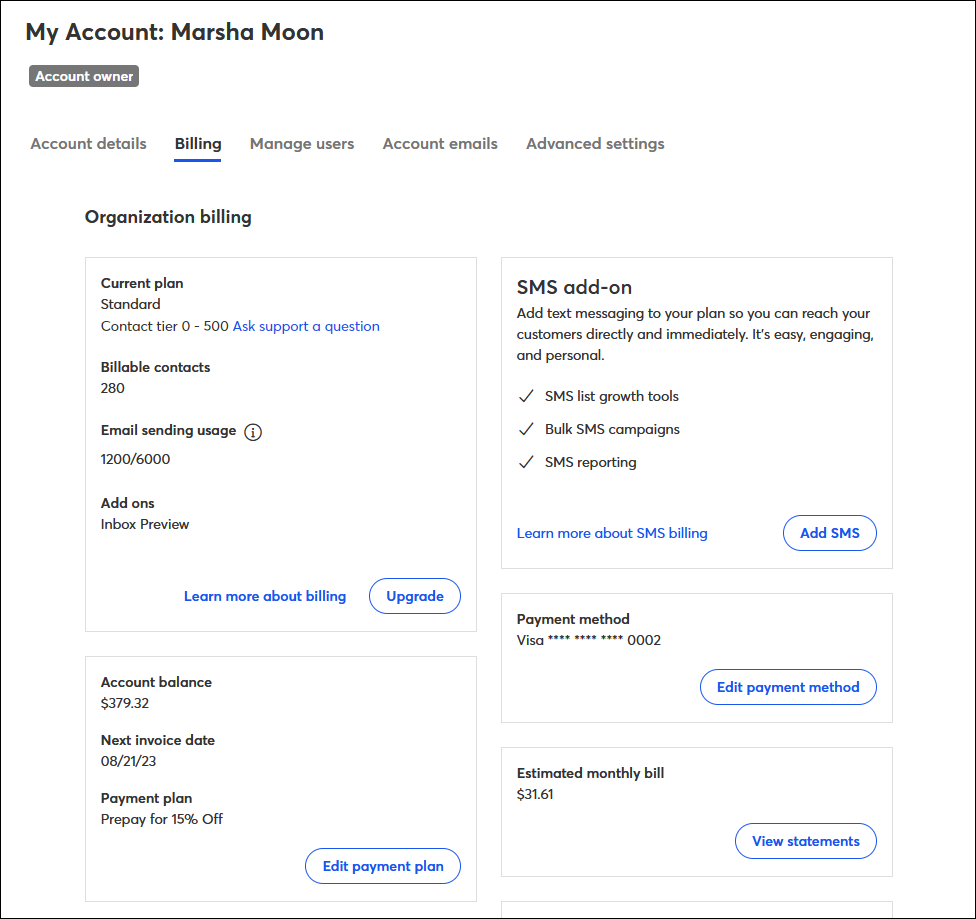

From the Billing tab within your account settings, you can see your:

Your monthly bill is a combination of your selected plan and your contact tier. If your number of active contacts increased during the last billing period, you will move to a higher contact pricing tier. These charges are reflected in next month's bill. You can check your plan and pricing from the Account settings page.

Constant Contact also has a monthly email send allowance. If you exceed the allowance during the billing cycle, you're charged an overage fee. Learn more about Constant Contact’s email send allowance and overage fee.

If you notice any incorrect or multiple charges for the same invoice cycle, please call our Billing Support Team at your earliest convenience. They will be happy to assist you and correct any issues.

To ensure we're accounting for your contact needs, the highest number of contacts you’ve added to your account determines your contact tier. Deleting contacts does not lower the contact tier.

You're still charged your monthly fee even if you don't send a campaign. Paying the monthly fee keeps your account active so you can continue storing and managing your contact list, collecting new contacts through sign-up forms, and accessing your reporting.

Copyright © 2026 · All Rights Reserved · Constant Contact · Privacy Center